Executive Summary

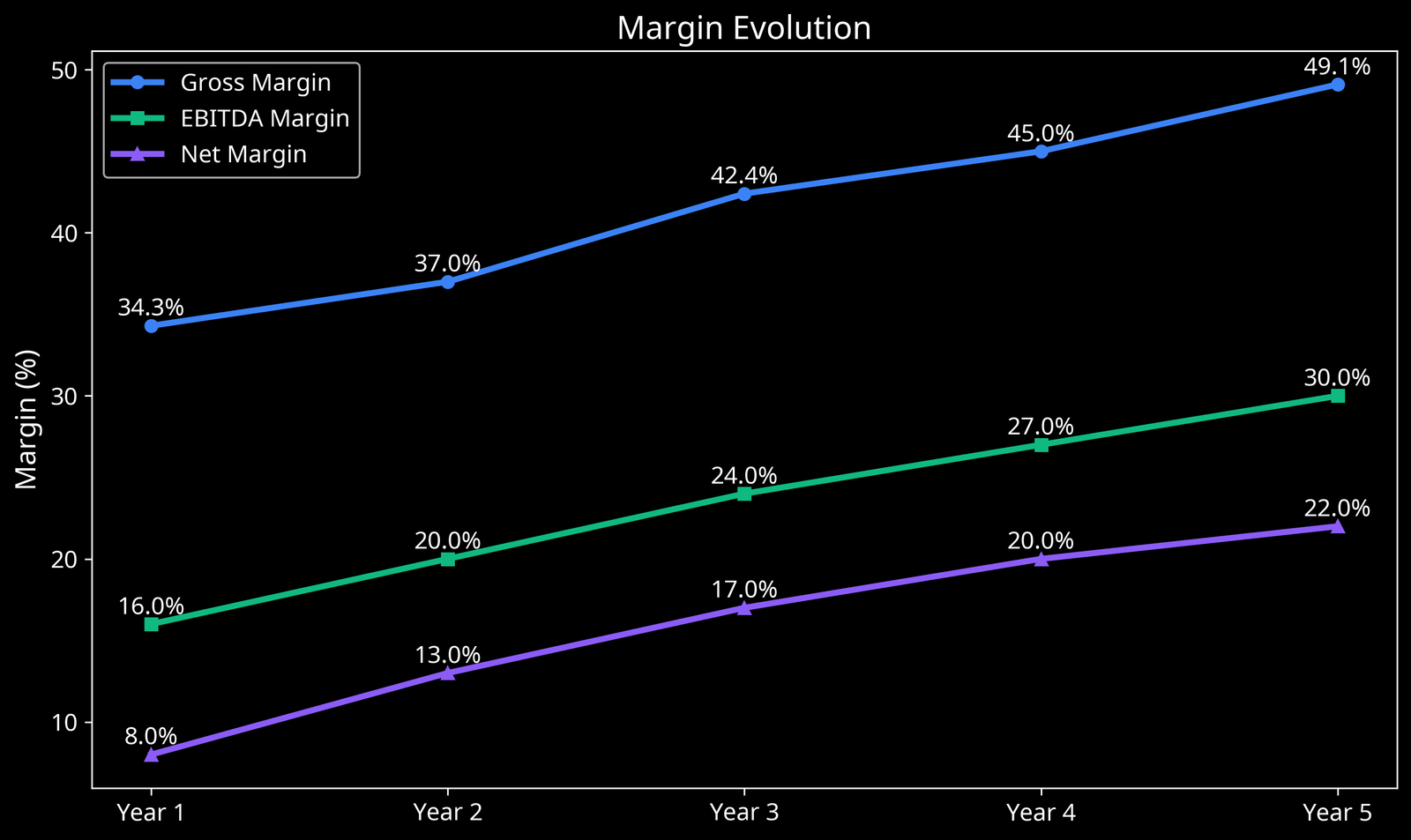

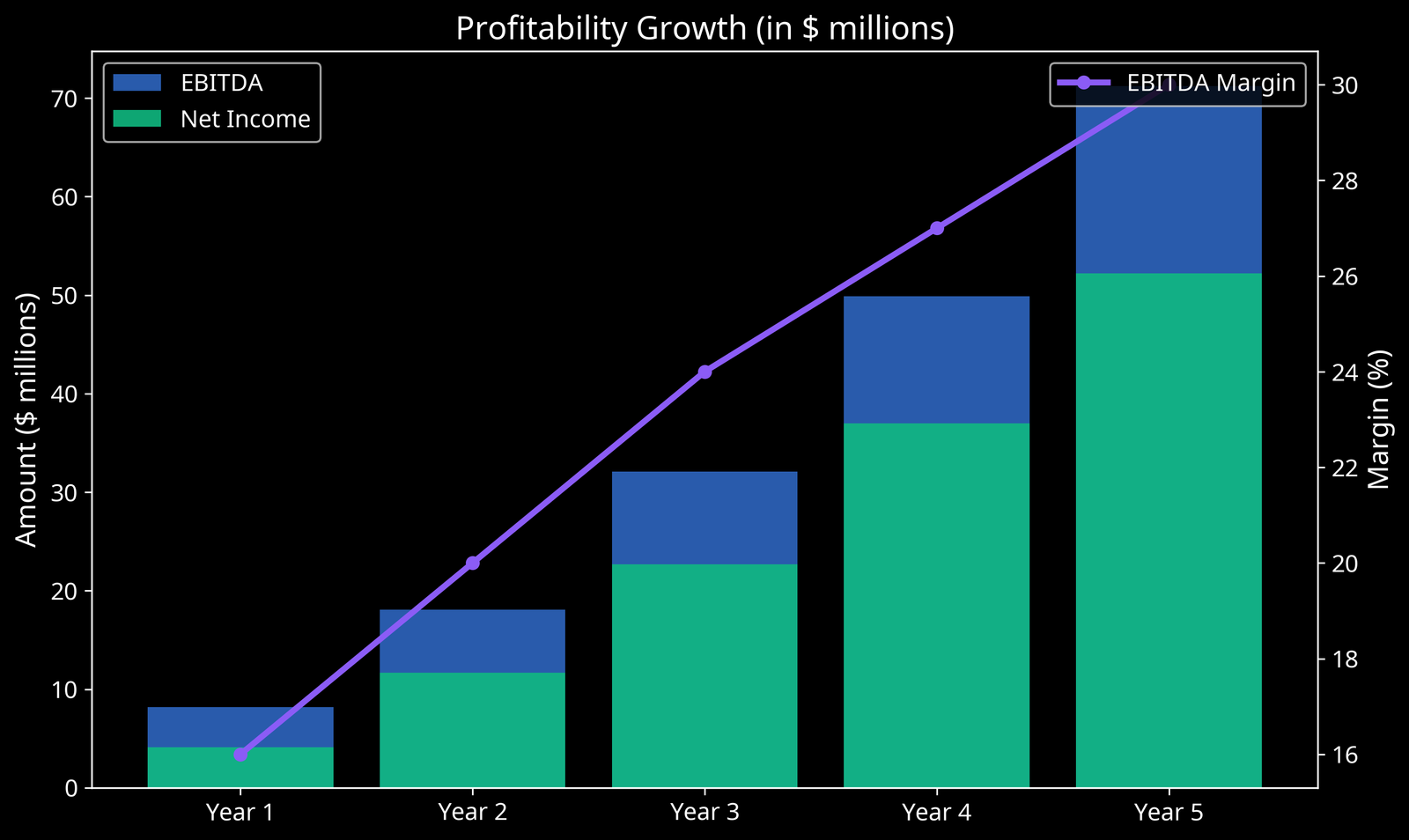

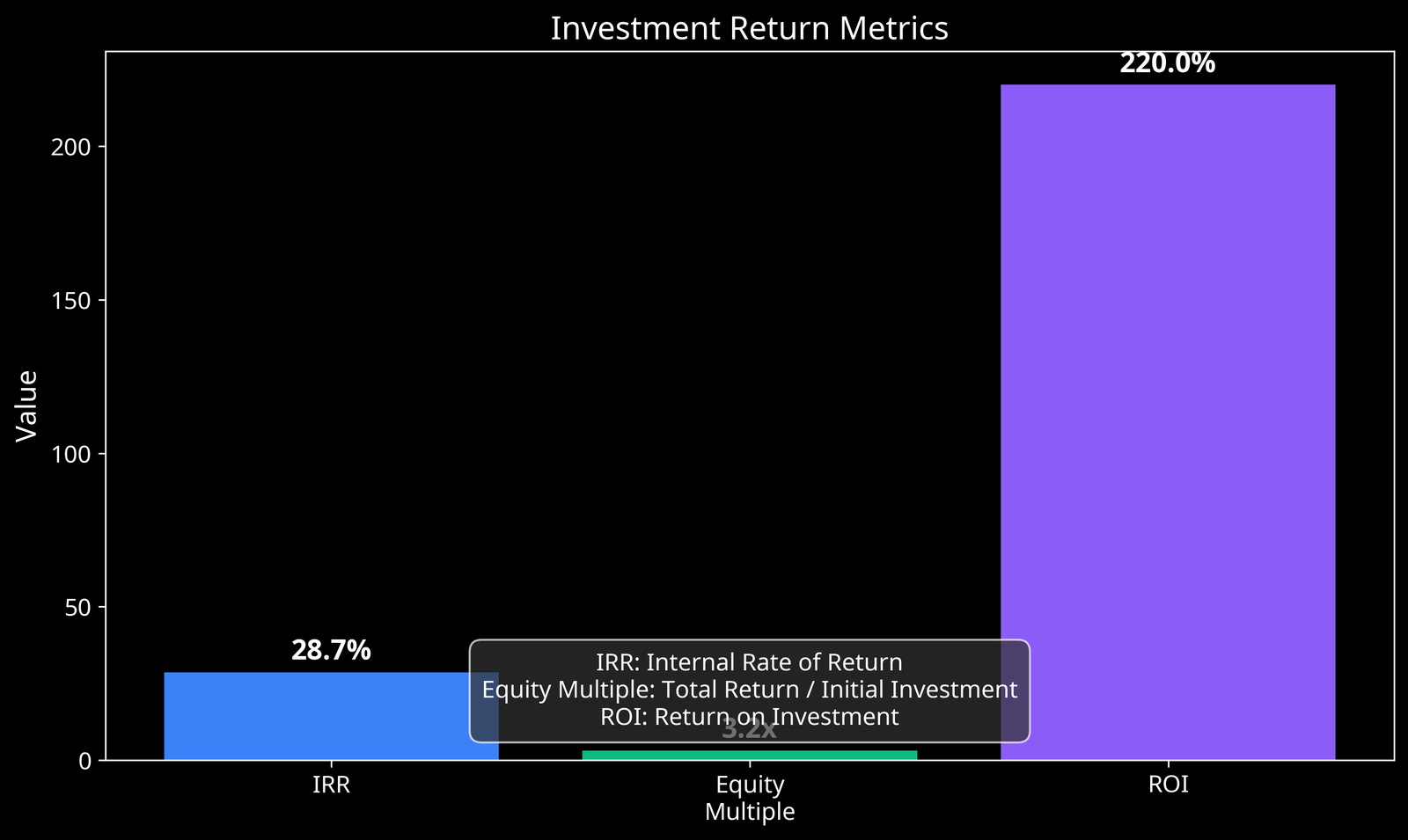

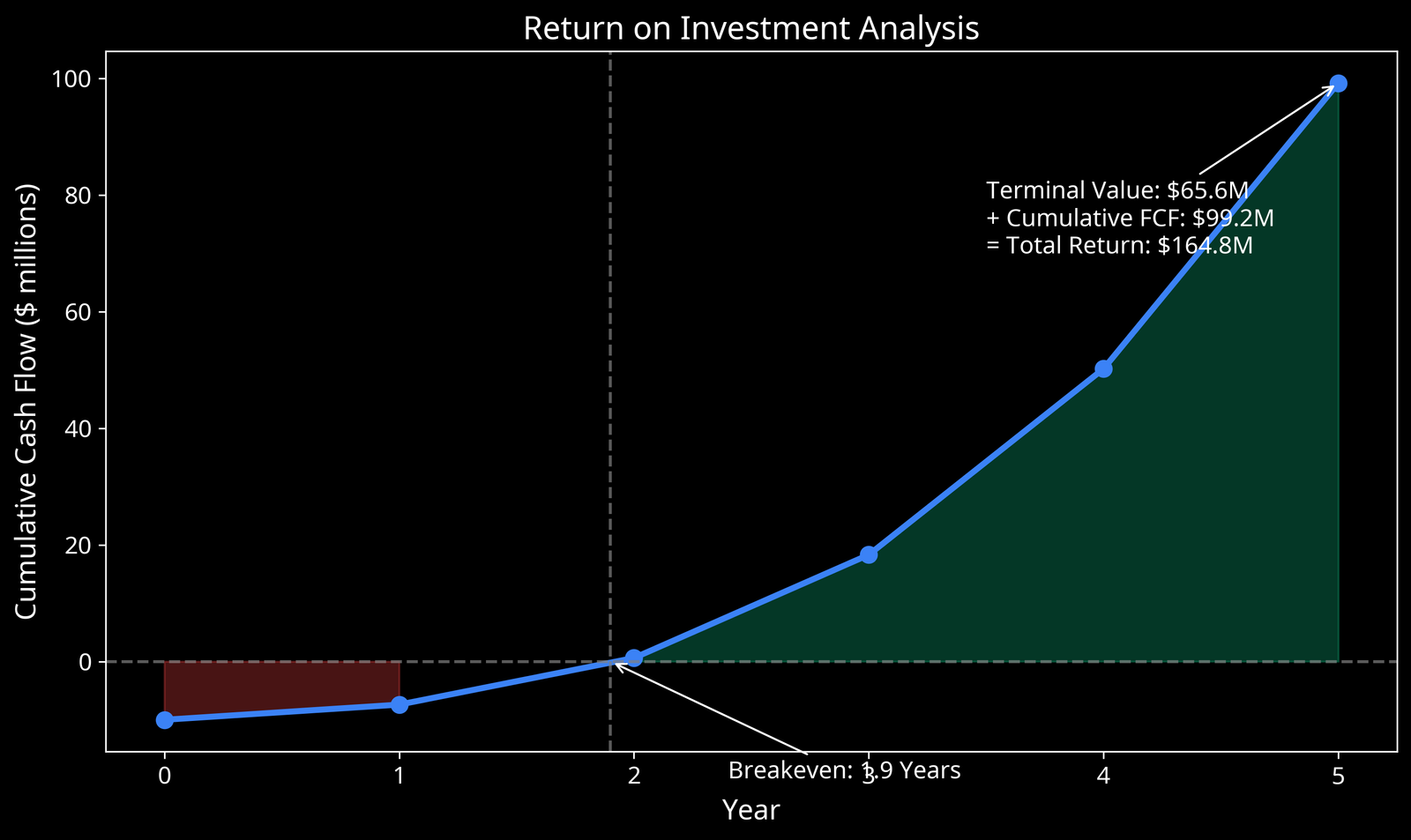

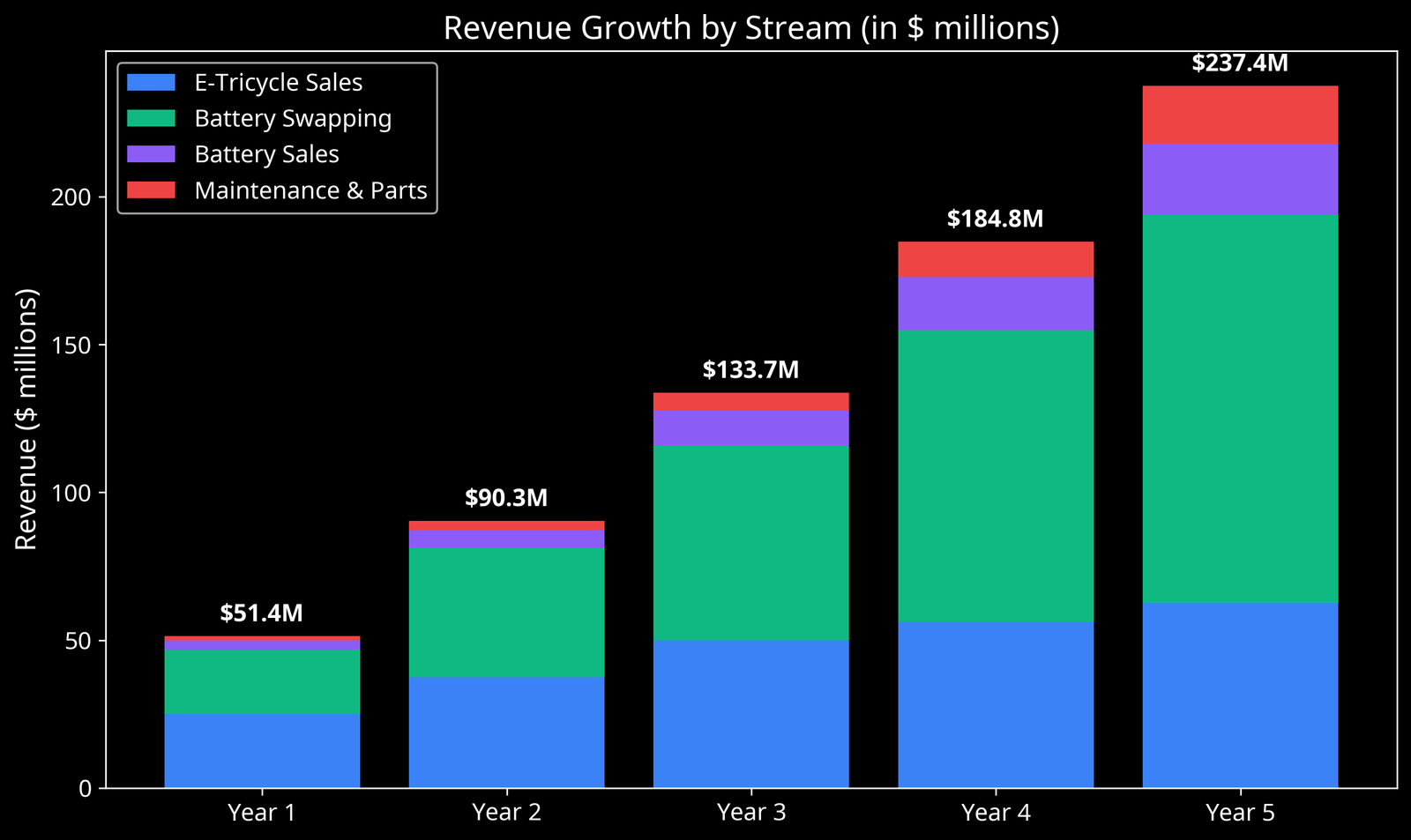

This financial projection outlines the expected performance of Zolair Energy Solutions Limited over a five-year period following the $10 million equity investment. The company's integrated e-tricycle and sodium-ion battery assembly plants are projected to achieve profitability by Year 3, with a cumulative EBITDA of $31.2 million by the end of Year 5. The investment offers an attractive IRR of 28.7% and an equity multiple of 3.2x over the five-year period.

Figure 1: Projected Revenue Growth Over 5 Years