Article content

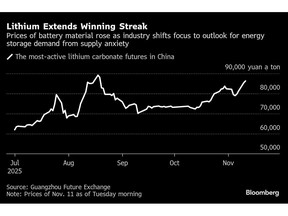

(Bloomberg) — The lithium industry is riding a wave of excitement over demand for large-scale battery storage, overshadowing the supply-side anxiety in China that has recently roiled the market.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The most-active futures for lithium carbonate — a battery material ingredient — extended gains in Guangzhou on Tuesday morning after jumping 5% in the previous session. Spot prices are at levels last seen in late August, but remain more than 85% below the peak in 2022.

Article content

Article content

Article content

“We think recent lithium momentum is driven by robust demand instead of potential supply disruption,” Citigroup Inc. analysts said in a note dated Nov. 9. “As time goes by, we gain more conviction on potential strong battery demand in the next couple of years.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The lithium market has been in turmoil over the past few months with the suspension of a mine run by the world’s biggest EV battery maker, Contemporary Amperex Technology Co. Ltd., in the spotlight. The company has been told how much it should pay for mining rights for the Jianxiawo project. Now, the market is shifting its focus to the demand front.

Article content

“Top-tier lithium iron phosphate, or LFP, cathode materials producers are mostly running at full capacity on energy storage demand,” said Su Jinyi, analyst at Sublime China Information Co.’s Fubao lithium battery department. “Looking forward, the strong ESS performance could support carbonate demand, but industry players still need to monitor how its strength and sustainability will actually be reflected in the lithium market,” she said.

Article content

The growing confidence in demand for energy storage systems, or ESS, comes amid policy incentives, improving economics and expansion plans. According to Citigroup, ESS will play an increasingly important role, accounting for about a third of total battery demand by 2030, up from around 20% last year.

Article content

Article content

“We acknowledge that there are limited forward indicators on ESS demand historically,” Citi analysts wrote. “However, we believe investment flow is unlikely to be wrong.”

Article content

Battery demand is forecast to grow by 31% on-year in 2026, and within that, demand for ESS and EVs is estimated to increase by 45% and 26%, respectively, the analysts said, adding that a potential restart of the CATL mine is “unlikely to change the destocking pattern.”

Article content

Still, some analysts warn the rate at which lithium prices are rising may be too much, too fast.

Article content

“The current price surge has been too rapid, and there’s a risk of pullback if the sentiment reverses,” said Zhang Weixin, analyst at China Futures Co. “The main trading logic has been centered around stronger demand in 2026, but the lithium market might still not see a shortage next year.”

Article content