By Rystad Energy – Dec 13, 2025, 12:00 PM CST

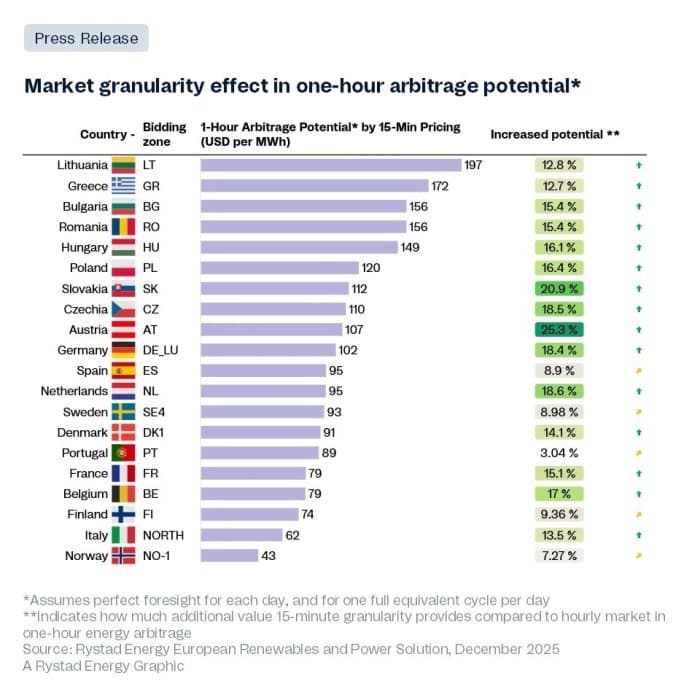

- Europe’s new 15-minute power pricing regime has increased arbitrage potential by an average of 14%, with several countries seeing gains above 20%.

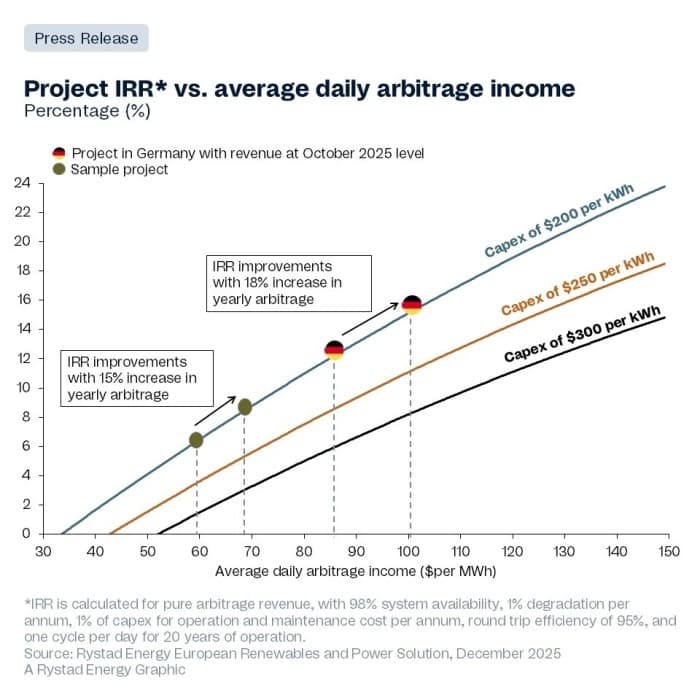

- Higher revenue volatility and more granular trading windows could lift long-term returns by roughly three percentage points for battery storage assets.

- While today’s arbitrage margins are unusually high, the structural shift mirrors Australia’s experience, where finer pricing intervals have consistently boosted storage profits.

The economics of battery storage systems (BESS) in Europe look much rosier following changes to the European Union’s (EU) power pricing structure in October, with several countries offering the potential for BESS profits to rise more than a 15%, according to Rystad Energy analysis. The new EU system sets power prices every 15 minutes, rather than every hour, giving BESS operators more opportunities to buy electricity when it’s cheap and sell it when prices rise. Since the new system was implemented, arbitrage potential has increased by 14% on average across European power markets. Some countries, such as Austria and Slovakia, saw gains of over 20%, while others, including Portugal, Norway and Sweden, experienced only minor improvements. If a battery earns around 20% more each year due to these price swings, its total return on investment can increase by about 3% over 20 years.

Traditionally, EU electricity prices have been set every hour. However, when markets move from hourly to 15-minute trading intervals, known as 15-minute Market Time Units (MTUs), new opportunities emerge to generate income. In October, when Europe’s day-ahead electricity market shifted from hourly to 15-minute MTUs, it enabled quarter-hour energy trading, which proved far more profitable than trading across a full hour. For example, in Lithuania, shifting energy over 15 minutes earned about $263 per megawatt-hour (MWh), 14% more than hourly trading. In Germany, quarter-hour arbitrage was 16% more profitable than hourly arbitrage.

In countries with less flexibility in power generation and consumption, high share of intermittent renewables can cause large price swings. Rapid changes in wind or solar generation mean electricity prices can shift noticeably even within a single hour. Shorter 15-minute trading intervals capture these quick shifts, creating more opportunities for flexible assets. In contrast, in places with a flexible electricity supply, such as Norway with hydropower and Portugal with hydropower and gas, prices are more stable over an hour. As a result, the difference between profits from 15-minute and hourly trading is much smaller.

Sepehr Soltani, Senior Analyst, Energy Storage, Rystad Energy

Rystad Energy’s analysis compared potential profits from 1-hour energy arbitrage in European power markets under two scenarios. Under the 15-minute markets scenario, one arbitrage cycle requires four charging and four discharging steps. In the 60-minute markets scenario, the same cycle needs only a single charge and discharge. The results suggest that shifting to shorter trading intervals could enhance revenue opportunities for European storage operators.

However, there is an important caveat. Today’s unusually high arbitrage margins, roughly +$150 per MWh, are not expected to persist over the next 10–20 years. A more realistic long-term average is around $60 per MWh, corresponding to an internal rate of return (IRR) of approximately 6% from pure energy arbitrage. Increased market granularity could lift average revenues to roughly $70 per MWh, adding around three percentage points to IRR.

The biggest challenge for earning money through arbitrage is that price volatility is unpredictable. In Europe, 15-minute markets only started two months ago. Australia, however, switched from 30-minute to 5-minute markets in 2021 and since then, the finer time intervals have consistently increased arbitrage profits.

Sepehr Soltani, Senior Analyst, Energy Storage, Rystad Energy

For example, in the Australia’s New South Wales state, 5-minute pricing has produced about 20% higher yearly arbitrage revenues than the old 30-minute system. In Victoria, 5-minute prices have generated around 15% higher revenues for 1-hour arbitrage over the past four years.

Ultimately, arbitrage opportunities can serve as a useful indicator for potential maximum profits for a BESS project. However, real-world arbitrage revenues on day-ahead markets will be lower once factors such as efficiency losses, system availability, market liquidity, and hedging strategies that mitigate reliance on one-off extreme price spikes are considered.

By Rystad Energy

More Top Reads From Oilprice.com

- Russia-China Gas Pipeline Could Take 10 Years to Build

- Oil Tanker Rates Skyrocket 467%

- Shadow Fleet on Edge After U.S. Seizes Tanker in Venezuelan Waters

Download The Free Oilprice App Today

Back to homepage

![]()

Rystad Energy

Rystad Energy is an independent energy consulting services and business intelligence provider offering global databases, strategic advisory and research products for energy companies and suppliers,…

More Info

Related posts

Leave a comment

![Regina Daniels Suprises Her Mother Rita Daniels With Two Cars As Valentine Gift [Video]](https://zolairenergy.com/wp-content/uploads/2026/02/18837-regina-daniels-suprises-her-mother-rita-daniels-with-two-cars-as-valentine-gift-video-80x80.jpg)