In 2025, Nigeria’s wealthiest business leaders are accelerating their shift away from oil, signalling a decisive pivot to renewable energy startups, especially off-grid solar, electric vehicles (EVs), and battery-swapping infrastructure. This trend isn’t driven solely by environmental idealism. For Nigeria’s billionaire class, it’s about scale, necessity, and first-mover advantage in a sector that promises both financial and social returns.

A New Playbook for Energy Investment

For decades, oil was the primary route to immense wealth in Nigeria. However, today several forces are rewriting that playbook – the volatility of global oil markets, chronic power deficits, surging diesel costs, and firm government policy nudges toward sustainable alternatives. With Nigeria’s Renewable Energy Master Plan targeting a 10% renewable share by 2025, new investment avenues are opening up fast.

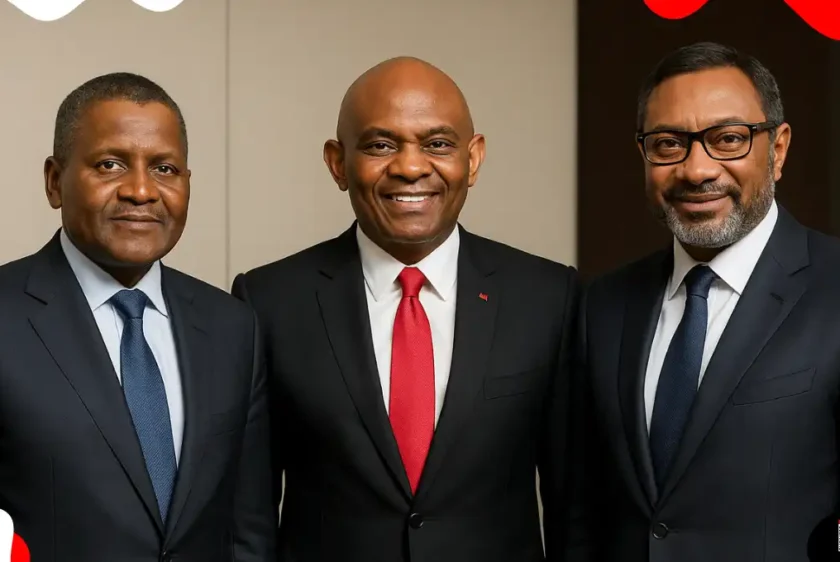

Billionaires like Aliko Dangote, Tony Elumelu, Femi Otedola, and Abdulsamad Rabiu are quietly yet aggressively building new portfolios in renewable energy. Their investments are now shaping a sector that, until recently, was dominated by Development finance institutions (DFIs) and impact investors.

The Off-Grid Magnet

Nowhere is billionaire activity more evident than in the off-grid solar sector. The reasons are not far-fetched. Nigeria’s national grid is notoriously unreliable, with over 80 million people lacking access to consistent electricity. SMEs, which account for roughly half of Nigeria’s GDP, are crippled by frequent blackouts and rising diesel costs (up over 500% since the 2023 subsidy removal).

In April 2025, Arnergy, a leading solar energy startup, raised $18 million in Series B funding led by CardinalStone, with earlier backing from Breakthrough Energy Ventures, an investment group linked to Bill Gates. Arnergy specialises in pay-as-you-go solar solutions for businesses and rural communities, a market that is now growing at a double-digit annual rate.

Arnergy’s CEO, Femi Adeyemo, describes the sector that is winning over billionaire investors as a necessity for business growth in today’s economy:

“When we started the business, we used to position solar as a way to get uninterrupted power, not necessarily to save money. It wasn’t part of a commercial conversation”, Adeyemo said. “Now it is, because we can clearly show customers how our systems save them monthly, whether using petrol, diesel, or even the grid.”

Another example is Green Village Electricity (GVE), led by Ifeanyi Orajaka, which delivers mini-grid solar to underserved communities. Studies comparing mini-grid deployment in Kenya and Nigeria reveal that household incomes have quadrupled in some beneficiary communities, while health and educational outcomes have also improved. It’s this combination of commercial viability and broad-based impact that’s attracting big money.

EVs and Battery Swapping – Transport’s Next Frontier

While solar energy is addressing Nigeria’s power crisis, the country’s transport sector is undergoing a quiet revolution. Startups like MAX are using EVs and battery-swapping technology to disrupt commercial transportation.

In 2021, MAX.ng, now branded to MAX, closed a $31 million Series B round to scale its electric vehicle and battery-swap network for the gig economy. Its model enables riders and drivers to purchase EVs and swap batteries at strategically located hubs, thereby slashing downtime and operating costs.

The economics are compelling. EVs, paired with battery-swapping infrastructure, can reduce the cost of transportation by up to 40% compared to petrol and diesel alternatives. MAX isn’t alone. Spiro, an African mobility giant, partnered with YourRider in April 2025 to expand Nigeria’s battery-swap infrastructure, making EV adoption practical for thousands of riders.

These investments are not merely experimental. China’s BAIC Group, one of the world’s largest EV manufacturers, is in advanced talks with the Energy Commission of Nigeria (ECN) to localise battery-swap technology.

Nigeria is moving to accelerate green innovation through cross-border collaborations, according to Dr. Mustapha Abdullahi, who heads the ECN. He noted that the country is actively exploring partnerships

Policy, Institutional Capital, and a New Funding Blueprint

designed to advance sustainable technologies and industry growth.

In March 2025, the government earmarked ₦151.9 billion to roll out electric buses, tricycles, and charging stations throughout the North-East. This funding package aims to reduce carbon emissions and bring electric mobility to communities that have traditionally lacked access to clean transportation solutions.

Development finance institutions, notably the World Bank and AfDB, have committed $80 million to support off-grid solar loan facilities for SMEs and rural communities. Sun King, a leader in pay-as-you-go solar, is already deploying these funds, enabling more Nigerians to finance solar with local-currency loans.

Several international and domestic banks, including Société Générale, Afreximbank, and Equitane, have injected over $100 million into Spiro’s EV rollout across Africa, with Nigeria as a central market. DFIs have co-invested with Nigerian billionaires in Husk Power’s $5 million hybrid mini-grid expansion, further highlighting the appetite for blended finance models.

The Billionaires Perspective

For Nigeria’s wealthiest, the appeal of renewable energy is twofold. First, it serves as a hedge against the risks of overexposure to oil and gas. Second, it offers long-term, defensible cash flows in sectors with massive unmet demand. Tony Elumelu’s Heirs Holdings, for instance, is increasingly focused on power sector deals, pairing legacy oil assets with investments in solar, hydro, and clean-tech startups.

Aliko Dangote’s interest in renewables, while still dwarfed by his cement and refinery operations, is unmistakable. Dangote Industries has signalled its intent to enter large-scale fertiliser and solar energy manufacturing, seeking synergies across the energy and agriculture value chain.

Femi Otedola, once synonymous with petroleum marketing, has sold off major fuel assets to focus on power generation and renewables. His investment in Geregu Power is now complemented by partnerships in solar grid infrastructure, and exploratory moves into electric transport.

Challenges on the Road Ahead

The sector’s promise does not obscure its hurdles. Nigeria’s grid remains unstable, and there’s a pressing need to localise battery production and component supply chains. Without this, cost advantages may evaporate as global demand for lithium and batteries intensifies. Policy risk and currency volatility persist, although both the government and private sector are showing greater alignment than ever.

Integrated public-private models are still in their early stages of development. Partnerships between distribution companies, such as Ikeja Electric, and private solar operators to build charging hubs are a step forward, but they require greater scale and coordination.